Crypto Volume Strength Comparator

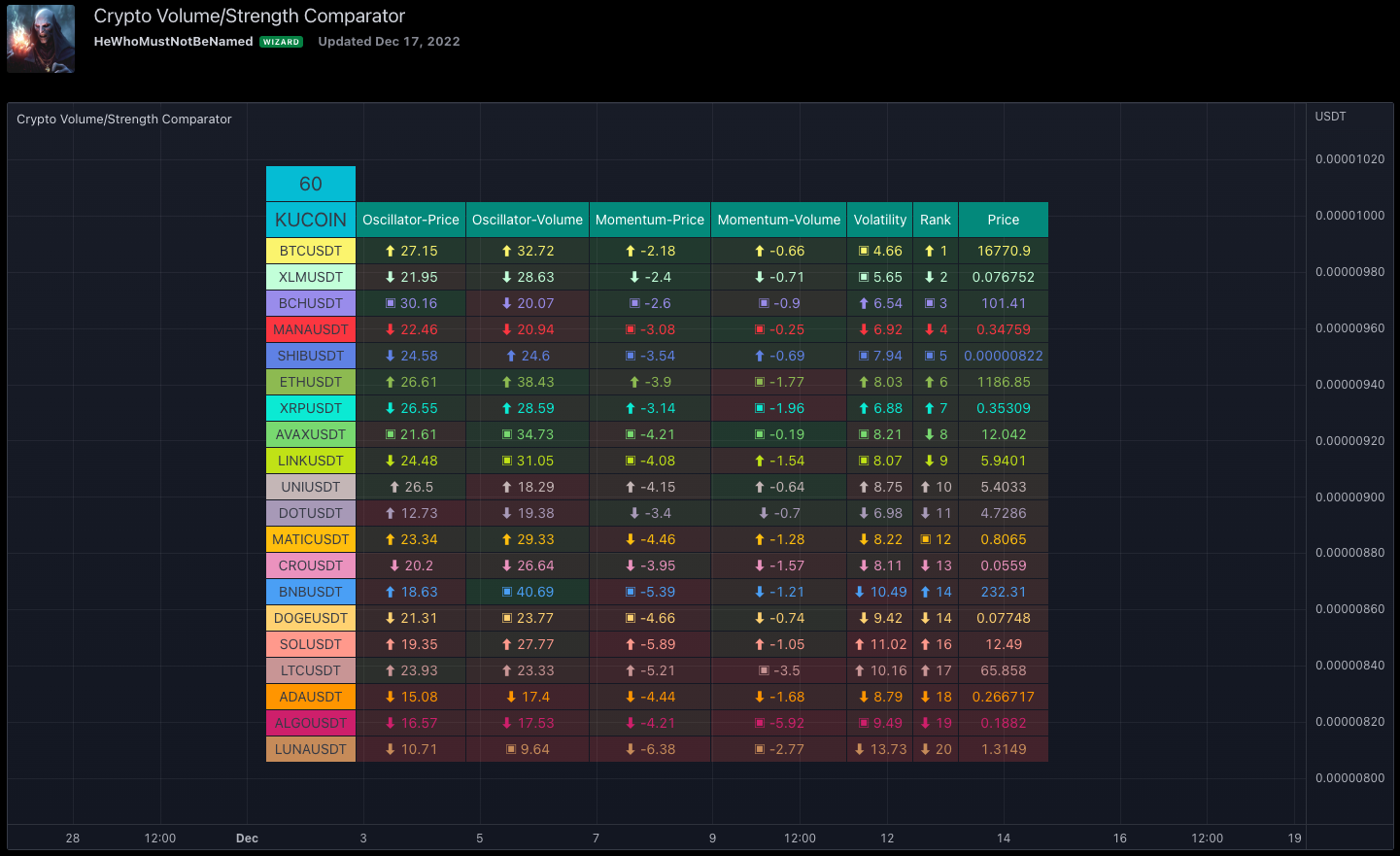

This analysis aims to compare leading cryptocurrencies based on technical indicators, specifically oscillator strength and trading volume. The methodology draws inspiration from the Magic Number formula outlined in the referenced post. However, instead of relying on fundamental metrics, this approach utilizes technical indicators to achieve similar outcomes. While the application of available data differs from the Magic Number due to the focus on technicals, the core concept of ranking and comparison remains consistent.

Link to the Indicator: Crypto Volume Strength Comparator

Related publication: Enhanced Magic Formula for fundamental analysis

Volume Strength Magic Number Methodology

The Crypto Volume Strength Comparator indicator adapts the Magic Number methodology to evaluate cryptocurrencies based on technical metrics. Below is a summary of the process:

- Identify the Crypto Exchange: Determine the exchange based on the prefix of the instrument being analyzed.

- Retrieve Ticker Data: Collect data for all tickers specified in the input fields for the selected exchange.

- Calculate Price-Based Metrics: Compute the Oscillator and Momentum for each ticker using price data.

- Calculate Volume-Based Metrics: Compute the Oscillator and Momentum for each ticker using volume data.

- Calculate Volatility: Assess Volatility for each ticker.

- Rank Metrics: Assign rankings for Price-Oscillator, Price-Momentum, Volume-Oscillator, Volume-Momentum, and Volatility for each ticker.

- Compute Combined Rank: Aggregate individual ranks to derive a composite rank for each ticker.

- Track Rank Movement: Monitor changes in rankings from one time period to the next.

- Sort and Display: Arrange tickers by rank in a table, highlighting the direction of rank movements.

Chart Components of Volume Strength Comparator

Display components are as follows. The indicator visualizes the ranked tickers and their metrics

Settings of the Comparator Indicator

Settings are pretty simple and straightforward and provides user-friendly options to configure the indicator.

Calculations

The indicator relies on the following technical metrics:

- Oscillators: Higher oscillator values are preferred, as the indicator is geared toward identifying trending assets.

- Momentum: Calculated using the Squeeze Momentum Indicator by @LazyBear.

- Volatility: Derived from the Williams VIX Fix by @ChrisMoody. Lower VIX Fix values are favoured in trend-following mode.

Notes

- Exchange Limitations: Tickers will only display data if they are available on the selected exchange. Unavailable tickers will show "NaN" due to the requirement for fixed-size arrays in calculations.

- Crypto-Specific: The indicator is exclusively compatible with cryptocurrency tickers from valid exchanges.

- Real-Time Updates: Rankings update dynamically, with a gradient background (green to red) reflecting performance.

- Interpretation Caution: Tickers at the top of the ranking may not always represent the best long opportunities, and those at the bottom may not be ideal for shorting. Consider the duration a ticker remains in its rank and the speed of its movement in the opposite direction. The table includes directional arrows to indicate ranking trends.

Comments